Your Cart

12-Month

Warranty

30-Day Money

Back Guarantee

Limited Quantity,

Order Today

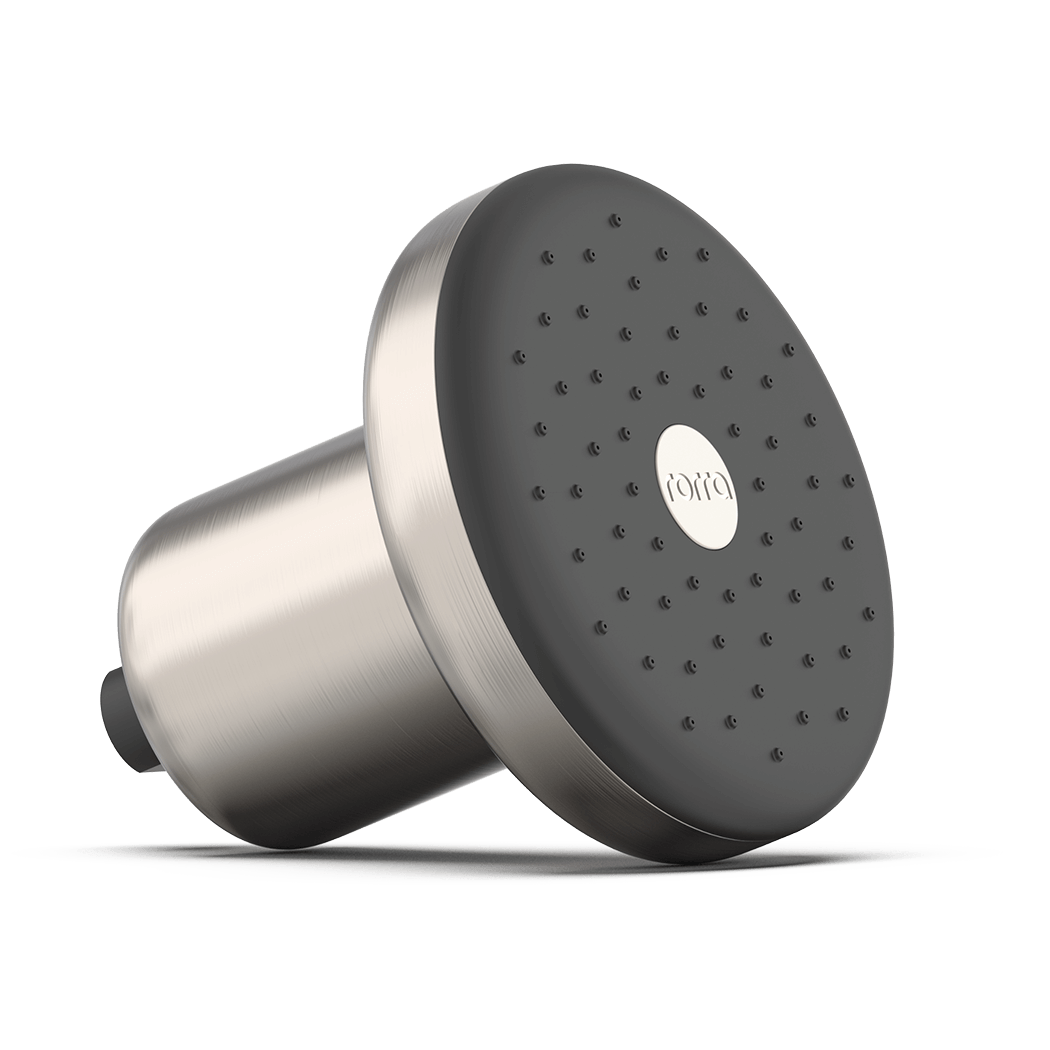

Add a Filtered Showerhead + Subscription to cart just for $100

Add another Showerhead + Subscription for just $100

Select Showerhead Colorway

Military, First Responder, Government Employee and Teacher discount available. Verify your GovX ID to instantly unlock your savings.

Subtotal

Taxes and shipping calculated on checkout

Discount applied